Do you have a promising startup idea, a detailed business plan, and unstoppable energy? Is it left for you to have an investor put his financial wing on you? This is not a problem at all!

In this article, you will learn how to correctly and realistically find investors to build your marketplace from scratch and implement a startup idea.

Marketplace insights every startupper needs to know

Online marketplaces play an essential role in multi-channel commerce. They offer the opportunity to use a convenient online platform to distribute goods and services and reach more consumers. Also, these platforms increase the chances of receiving a more significant number of orders and growing sales.

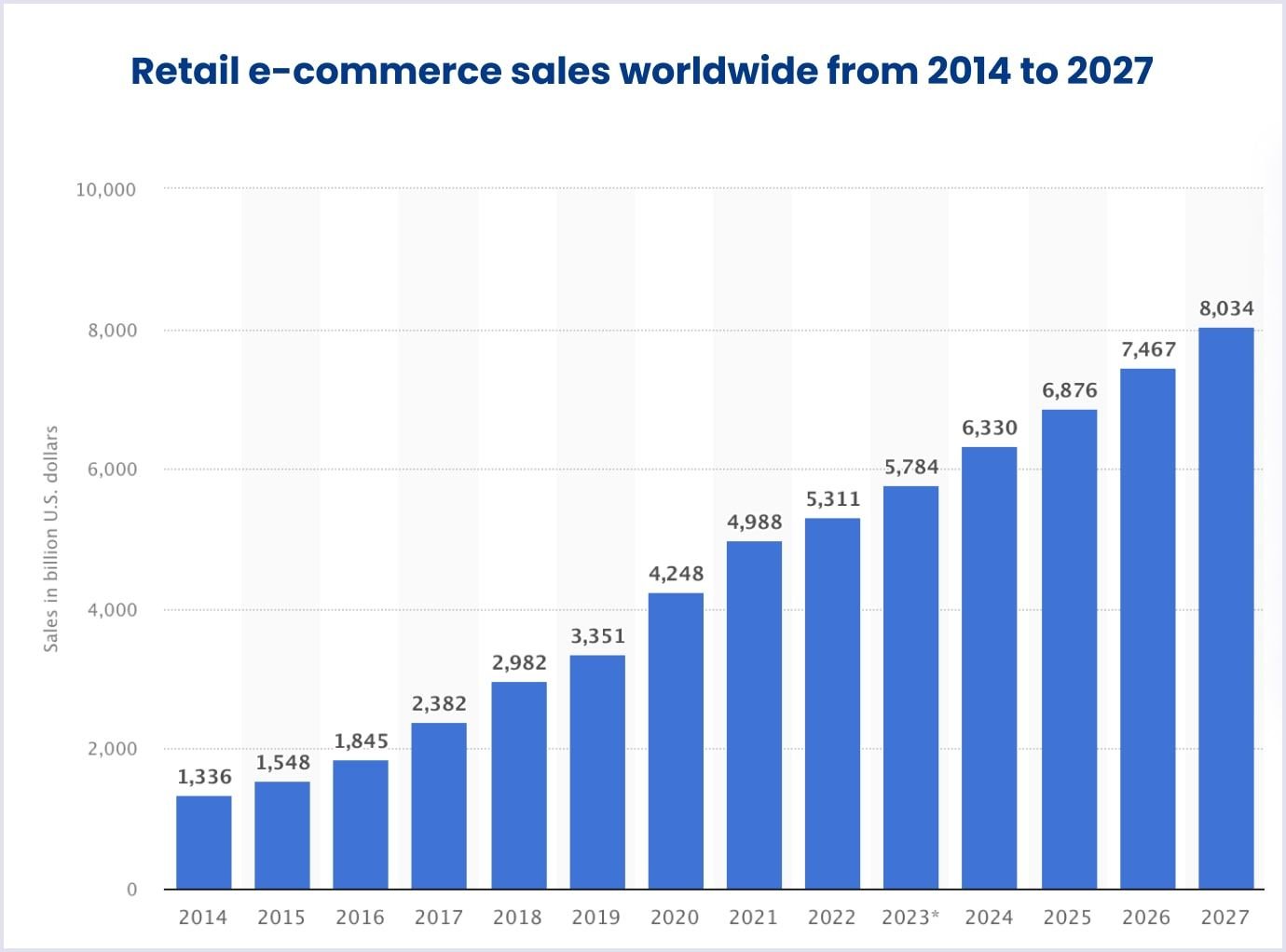

For example, in 2023, retail e-commerce sales amounted to approximately 5.7 trillion U.S. dollars worldwide.

By using online marketplaces, business founders can also reduce marketing and operational costs, start providing services quickly, and get an additional source of income.

Furthermore, there are the most critical indicators for online business and further marketplace fundraising:

- Value. Customer reviews, frequency of views.

- Retention. This is a fundamental indicator of how effectively your market retains customers.

- Growth. If your business is growing in scale, raising capital will take less time.

- Net income. Define your monetization model and maintain stable earnings growth.

You may also like: An Online Marketplace Marketing Strategy That Works in 2024

How to choose the right time to enter the market

If you know your startup idea well and see an opportunity for development, it could be time to enter a market. It’s important to understand that despite economic downturns in the market, the crisis does not frighten potential investors. So, we are convinced crisis times require non-standard business solutions to create or invest in new products.

Various investment companies, accelerators, and business angels are often interested in financing attractive marketplaces. But why? With their wealth of experience and insightful approach, marketplace experts gain profit from the development of businesses to which they have allocated their funds.

However, from a business point of view, investment projects provide the transparency of markets and improve their liquidity. Therefore, marketplace investors can receive considerable passive income. Moreover, investors benefit from online platforms being well protected if these platforms work well. Also, they are attracted by the network effect of retaining loyal users.

As a result, interested marketplace investors agree to finance various e-commerce platforms, as these platforms simplify entry barriers and guarantee healthy fields and proven business models in multiple sectors.

Main stages of raising funds

When considering operating investments in your startup, it is also essential to understand the specifics of the funding stages. Then, business owners can assess their startup's stage of operation and which top investors can take it to the next step.

Let's take a closer look at the best funding stages for your marketplace startups.

1. Pre-seed stage

At the initial investment stage, the founders are just beginning their activities to make their startup a reality. Therefore, their resources are quite limited. The main sources of pre-seed financing are own savings and, for example, financial support from relatives and friends.

On the other hand, business presentations can also contribute to an additional funding source at the pre-seed stage. So, at an early stage, various institutes or organizations can provide prize money, grants, or other financial benefits for unique business plans and pitches.

The total value of a startup in this stage can range from $10,000 to $100,000.

2. Seed stage

Seed funding means big investors give funds in exchange for a company share. So, the founders check the potential demand for their startups and conduct a proof of concept (POC).

Moreover, founders can conduct market tests and recruit mentors. For example, incubators, accelerators, business angels, and crowdfunding platforms are typical funding sources at the seed rounds.

Seed capital typically ranges from $100,000 to $500,000.

3. Series A stage

This stage begins when you have introduced the products and services of your startup to the market. At that time, your marketplace investors closely monitor the startup's key performance metrics. It is mostly about researching the client base or income indicators.

In fact, this stage initiates venture capital (VC) funding. Therefore, with such marketplace investments, there is already an opportunity to attract new customers, launch new products and services, and expand the scale of the startup.

At this stage, VC firms and super angel investors are the most popular funding sources. The average Series A round is between $2 million and $5 million, with the expressed goals of funding early-stage business operations.

4. Growth stage

Here, startups are characterized by rapid market growth, increased revenue, and even market expansion. B, C, and D rounds contribute to the effective promotion of business. Therefore, the founders use funds from VC firms or private companies in the late-stage venture.

On the other hand, private equity firms primarily do not finance startups. However, such companies still believe in the potential and allocate funds for startups, for example, series C and D funding.

In the Series B round, you can generally raise $5 million to $10 million, but sometimes you can get to $20 million in capital or more. Then, Series C and D may raise between $5 million and $20 million or more.

5 methods to get funding for your online startup

Logically, the question arises of how to raise funds for your online marketplace startup launch. It would help if you got a detailed understanding of the areas of marketplace fundraising. Therefore, it is vital to consider the most proven financing approaches and their advantages and disadvantages.

Bootstrapping

With the bootstrapping approach, you build a business from scratch using only personal savings and operating income without external investment. Minimal resources can stifle growth, hinder promotion, and even undermine the quality of the product loaded. However, in the early stages, entrepreneurs retain complete control over the business, operate resources, and make all decisions. Therefore, you do not have to pay any debts in case of failure.

Then, you continue to reinvest operating income and grow your small e-commerce, relying only on personal resources.

Advantages. This approach allows business owners to experiment more with their brand, as there is no pressure from marketplace investors. As a result, you are entirely independent in actions regarding your startup. One of the main advantages of this approach is also time-saving. After all, you can start when you are ready and do not waste time and effort to find marketplace investors.

Disadvantages. A common drawback of bootstrapping is primarily the lack of trust in your brand at the early stage venture. Thus, the support of top investors can automatically give e-commerce higher visibility and more respect from sellers and customers.

Next, working alone also can be difficult. Without technical supervision and financial support from marketplace experts, it can be challenging for you to work alone. Moreover, this stage requires raising capital, which forces you to look for another way to raise funds for your online marketplace.

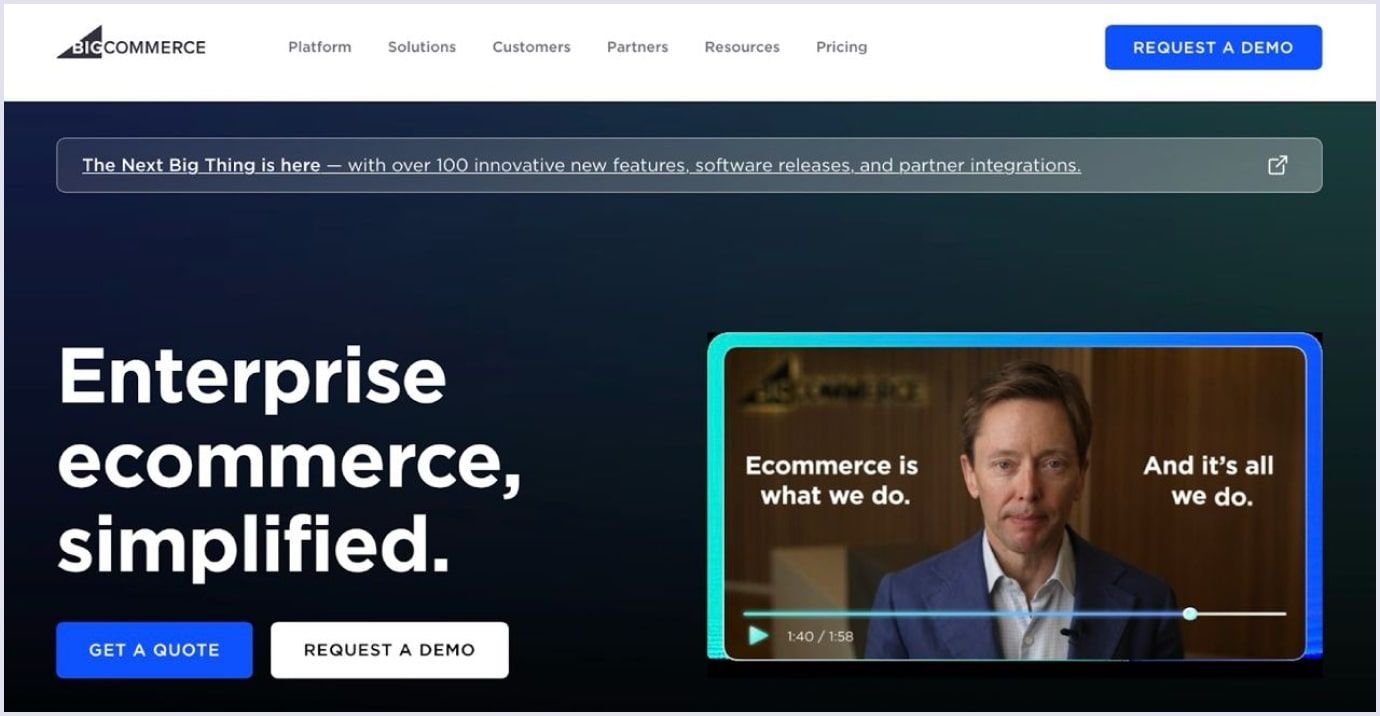

Example. BigCommerce is an excellent example of a marketplace company funded by bootstrapping. It is the leading ecommerce marketplace platform for fast-growing B2C and B2B brands. BigCommerce is focusing its strategic vector, marketplace investments, and resources on becoming a leader in enterprise e-commerce.

Other examples include Basecamp, Braintree, GitHub, Mailchimp, TechCrunch, and many more.

Crowdfunding

It is well-known that crowdfunding helps spread the word about your startup and raise total funding amount from individuals or communities on specific online platforms. You can choose one of the many online crowdfunding platforms or combine several.

To launch a campaign on a crowdfunding site, you need more thorough preparation and research because the idea is no longer enough. Moreover, it is crucial to attract the business community's attention, prove the quality of your product, and get funds.

Advantages. With this financing approach, you own your business fully. What's more, you can get the financing you want quickly. At the same time, you won't lose your own money if the startup fails.

Disadvantages. It is essential to understand that attracting top investors requires a lot of your effort. Also, marketplace investors need something in return for their investment, such as benefits.

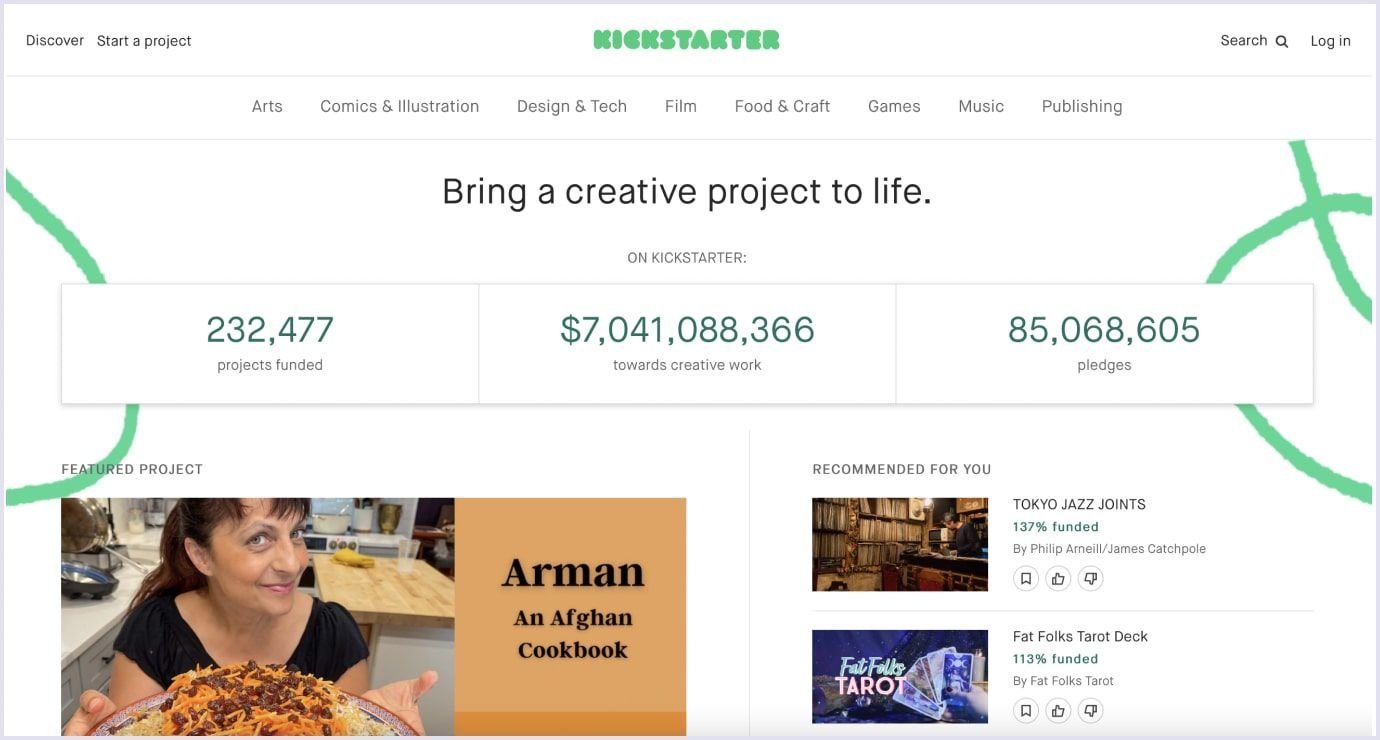

Example. Kickstarter has one of the highest success rates among crowdfunding platforms. This platform supports projects from various fields, from art to technology. Kickstarter ensures that startup founders retain 100% ownership of their projects. However, this platform interacts with only 18 countries.

Also, well-known crowdfunding platforms are WeFunder, Fundable, Indiegogo, and GoFundMe.

Incubators and accelerators

Incubators provide a favorable environment where you can get the capital you need and learn a lot of important things for a successful future. In addition to financial support, incubators and accelerators also help with marketing and advertising tasks. Moreover, they can build a network of potential investors and partners.

Accelerators and incubators select several of the most promising marketplace startups and invite them to a unique acceleration program. This method lets you meet with top investors and receive marketing, networking, infrastructure, and financial assistance.

Finally, participants meet with marketplace investors after completing the program and make a pitch to convince them to invest in their startups. Furthermore, the startup owner needs to share capital with the accelerator’s general partner.

Advantages. You can participate in mentoring programs and get a reliable learning environment. Therefore, based on the acquired knowledge and support from marketplace investors, you can increase your influence on potential customers and partners. Moreover, with business incubators and accelerators, you can meet world-famous business people and learn their secrets to success.

Disadvantages. First of all, you should be aware of the great competition. Therefore, startup founders often have to wait a long time between cycles to enter an accelerator program. On the other hand, a partial relinquishment of ownership of the company is expected for business owners, approximately 5-10% for investors.

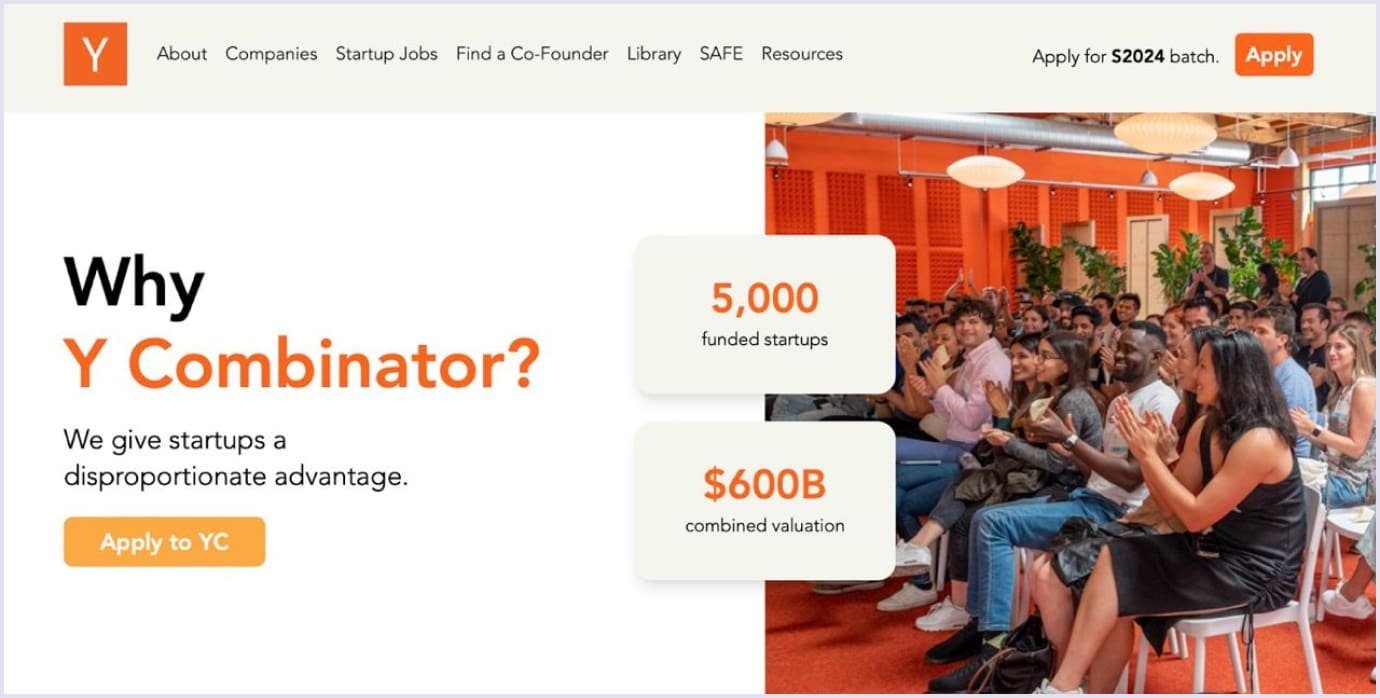

Example. An excellent example of a business incubator is Y Combinator. This incubator invests $150,000 in the company in exchange for a 7% market share. Therefore, the company chooses more than 200 startups for cooperation annually. This platform has become the key to success for many well-known businesses, such as Airbnb, Cruise, Dropbox, Gusto Instacart, Stripe, and others.

Also, well-known examples of reliable accelerators are 500 Startups and Techstars.

Venture capital funding

At this stage of financing your startup, you can get marketplace investments from VC firms. In return, venture capitalists will receive money from you through deferred profits and shares. Also, they can influence your company's development and make decisions. Moreover, VC firms can provide you with professional and valuable business support.

As a result, startup financing from VC firms makes it possible to receive multimillion-dollar investments. However, this lengthy process requires a lot of time and effort.

Advantages. With venture capital funding, you benefit from the fact that VC firms are not limited in their budgets. Therefore, these billion-dollar companies usually provide startups with the necessary investments. At the same time, you do not pay investors an application fee.

Disadvantages. With the advent of VC funding, your financial freedom becomes limited. Because VC firm's representatives influence decision-making in the startup. Finally, you give up part of the company's ownership to the investors.

Example. FJ Labs focuses on global markets and consumer-facing startups, including B2B and B2C markets. This platform has supported more than 500 projects worldwide. For example, Alibaba and OLX used the sponsorship of FJ Labs.

Angel investment

Here, you need to find an influential marketing specialist or wealthy person willing to invest in your startup in exchange for a stake in your business. It takes a lot of work to find angel investors.

Advantages. In fact, you get support from angel investors. Angel investors are usually considered the best funding option for pre-seed and early-stage startups because angel investors provide more than money. Some angel investors offer mentorship, business advice, guidance, and connections to startups from all stages. Moreover, most angel investors are entrepreneurs who know what challenges startups face and what they need to overcome.

Disadvantages. First, finding business angels and getting them interested in your project is challenging. From the beginning of the financing, you will get limited funds from the angel investors that the first round of funding requires.

Example. Loopie Laundry started with money from an angel investor and marketing specialist, Jason Calacanis. Loopie Laundry is a laundry pick-up and delivery service. The amount of funds raised in the funding round is $1 million. Therefore, Jason Calacanis has made 50 personal investments.

Key trends that will shape the future of marketplace development

The main requirements for online markets remain convenience, customer support, and a secure payment system. Let's look at the most popular online marketplace investing domains. Education Among the trends in this industry, it is worth mentioning on-demand education, which helps people acquire relevant skills, and distance learning and home learning.

Examples. Wyzant, Coursera, Preply, Brainly, ClassDojo, and Remind are the top online marketplaces where students and educators solve their academic problems together.

Financial technology

Financial and trading consulting and insurance provider marketplaces are common trends in online marketplaces as they provide an opportunity to manage online investments. With these platforms, you can also perform brokerage services and operate cryptocurrency and NFTs (non-fungible tokens).

Examples. Excellent examples of the fintech industry are Robinhood, Webull, and Monzo.

Transport

Now there is an increase in demand for car travel within the city limits, while at the same time reducing the use of public transport. Moreover, micromobility with the help of e-scooters or electric bicycles has become a widespread trend.

Examples. You can take the well-known brands Uber, Lyft, or Lime as an example.

Food delivery

In the food delivery discourse, online grocery stores or, for example, organic food markets are in high demand among people.

Examples. Among the vital food delivery marketplaces, MilkRun, Instacart, Blue Apron, Hello Fresh, Cortilla, EzCater, and Ocado are common.

Health

Regarding health and wellness trends, people prefer online fitness marketplaces that connect gym clients and trainers for online classes. Also, other viral health trends are relaxation training, yoga, meditation, breathing exercises, and more.

Regarding favorite health tools, you may have heard about MyFitness and Pal Lifesum. These apps track your food intake and check calories you consume based on your diet plan.

Examples. We know two current examples of online health marketplaces, Wellhub and Classpass.

At Codica, we also deal with fitness platforms. For example, recently our team developed a progressive web application for fitness that connected trainers and their clients. The Impact app has dashboards that help trainers and clients create and review individual fitness programs, track progress and prescribe appropriate nutrition.

Learn how Codica provided a custom web application for Impact Personal Training in the following video.

MVP’s role in investing

Suppose you are still debating whether to create an MVP startup and raise investment. Then, it is crucial to understand that an MVP (minimum viable product) is the quickest way to gain traction and give investors promising reasons to invest. Marketplace experts can test something live and thus see the idea realization.

Let's say you already have a working MVP, an acceptable monetization model, and loyal customers. Then, you need to attract investor support and prove to them that your MVP is worth the investment for further product development. If you properly present the MVP to parties concerned along with a complete business plan, it will improve the perspectives of successful financing. Moreover, in the early stages, you will also need mentoring support.

After all, an MVP is cheaper and faster than any other way to launch a product. This process can increase the successful market discovery or determine your marketplace's viability. So, with MVP development services, you can get early customer feedback, a fast learning curve, efficient use of resources, and attract investors with early traction.

For example, well-known platforms like Uber, Airbnb, Facebook, and Amazon started as MVPs. As a result, at the late stage venture, they established their market viability and attracted influential investors.

Read more: MVP Development Cost: Main Aspects for Aspiring Entrepreneurs

Codica is a one-stop shop for minimum viable product development. Whether you need a web-based or mobile solution, we help you through all stages of MVP development.

At the company, we start our clients' projects with product discovery to minimize risks, save costs, and make informed decisions. So, you will receive many benefits from the Codica team. It is about clickable prototypes, time and cost estimation, a list of priority features, product specification, technical stack, product architecture, and recommendations on team composition. The video below shows a more detailed description of all deliverables.

Based on our experience, we recommend our beginner clients work with the agile development methodology. Thanks to this methodology, you will see results early, easily make changes as you go, and, for example, reduce the price of MVP app development services.

How does your business benefit from MVP development? MVP in software means a product with enough features to satisfy early users. This approach is the best for new product development, allowing you to test a hypothesis fast without significant investment. Moreover, you can launch quickly, minimize costs, and test your idea shortly.

Our team has created several successful MVP products for various companies worldwide. Thus, we have accumulated multi-domain expertise that our experts apply to our web projects.

For example, iExpedition is an Australia-based online expedition and adventure travel company that offers polar cruises. This travel marketplace platform allows tourists to search for and book Arctic and Antarctic trips.

Our team built a fast-loading and visually-appealing online travel marketplace to drive more customers and increase sales. Also, we created an efficient content management system to automate the booking process and handle all the cruise records easily.

Learn how this powerful global travel marketplace platform works.

Regarding Codica's experience in MVP software development, we are proud to say that our startup clients have raised millions of dollars in investment. At the same time, Ben Alexander, Founder of iExpedition, remained satisfied with the completed project for his online travel marketplace. The client enjoyed the entire development process and assessed our team as experts of the highest professional level with effective communication.

Below, you can see the client feedback video.

Final thoughts

It is necessary to understand that a business can't exist and develop without resources. Experienced business community long ago eliminated the illusion that you can start a business with only your own money. Sooner or later, successful business owners realize that without the involvement of outside investment, their company can't continue to grow rapidly and dynamically. And attracting investments is a full-fledged job that is part of the functional duties of any founder.

There are many opportunities to get financing for your business processes. It is essential to carefully research the above funding strategies and choose the best platforms to promote your startup. By properly managing the received investments, you can take your e-commerce company to a new level.

If you want to develop a reliable online marketplace development platform, contact the Codica team. Our experts will help you create and further support your projects. In our portfolio, you can see that we develop platforms for different industries.

Contact us to discuss your ideas and get more information about the specifics of online marketplaces.